Question 1.

What do you mean by ‘promissory note’? State the requisites of a promissory note with the help of some illustrations. [June 2013 (5 Marks)]

Answer:

A promissory instrument is an instrument in writing (not being a banknote or a currency note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument.

Requisites of a promissory note:

- A promissory note must be in writing, duly signed by its maker and prop¬erly stamped as per the Indian Stamp Act.

- It must contain an unconditional undertaking or promise to pay. Mere acknowledgement of indebtedness is not enough.

Example: If someone writes ‘I owe t 5,000 to Satya Prakash, it is not a promissory note. - It must contain a promise to pay money only.

Example: If someone writes ‘I promise to give Suresh a Maruti car it is not a promissory note.

- The parties (i.e. maker & payee) to a promissory note must be certain.

- A promissory note may be payable on demand or after a certain date. For example, it is written “three months after date promise to pay Satinder or order a sum of rupees Five Thousand only” is a promissory note.

- The sum payable mentioned must be certain or capable of being made certain.

Question 2.

What is a ‘promissory note’? [June 2014 (3 Marks)]

Answer:

A promissory instrument is an instrument in writing (not being a banknote or a currency note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument.

Requisites of a promissory note:

- A promissory note must be in writing, duly signed by its maker and prop¬erly stamped as per the Indian Stamp Act.

- It must contain an unconditional undertaking or promise to pay. Mere acknowledgement of indebtedness is not enough.

Example: If someone writes ‘I owe t 5,000 to Satya Prakash, it is not a promissory note. - It must contain a promise to pay money only.

Example: If someone writes ‘I promise to give Suresh a Maruti car it is not a promissory note.

- The parties (i.e. maker & payee) to a promissory note must be certain.

- A promissory note may be payable on demand or after a certain date. For example, it is written “three months after date I promise to pay Satinder or order a sum of rupees Five Thousand only” is a promissory note.

- The sum payable mentioned must be certain or capable of being made certain.

Question 3.

Define the term ‘bill of lading’ under the Indian Stamp Act, 1899. [Dec 2015 (5 Marks) |

Answer:

Bill of Lading [Section 2(4)]: Bill of Lading includes a “through bill lading” but does not include a mate’s receipt.

- A bill of lading is a receipt by the master of a ship for goods delivered to him for delivery to X (a person) or his assigns.

- Three copies are made, each signed by the master. One is kept by the con¬signor of the goods, one by the master of the ship and one is forwarded to the consignee, who, on receipt of it, acquires property in the goods.

- It is written evidence of a contract for the carriage and delivery of goods by sea, for certain freight.

- When goods are delivered onboard a ship, the receipt is given by the person in charge. This receipt is known as the mate’s receipt. The shipper of the goods returns this receipt to the master before the ship leaves and receives from him a bill of lading for the goods, signed by the master.

Question 4.

Explain the meaning of ‘Bill of Lading’ under The Indian Stamp Act, 1899. [June 2018 (5 Marks)]

Answer:

Bill of Lading [Section 2(4)]: Bill of Lading includes a “through bill lading” but does not include a mate’s receipt.

- A bill of lading is a receipt by the master of a ship for goods delivered to him for delivery to X (a person) or his assigns.

- Three copies are made, each signed by the master. One is kept by the con¬signor of the goods, one by the master of the ship and one is forwarded to the consignee, who, on receipt of it, acquires property in the goods.

- It is written evidence of a contract for the carriage and delivery of goods by sea, for certain freight.

- When goods are delivered onboard a ship, the receipt is given by the person in charge. This receipt is known as the mate’s receipt. The shipper of the goods returns this receipt to the master before the ship leaves and receives from him a bill of lading for the goods, signed by the master.

Question 5.

Define ‘Lease’ under the Indian Stamp Act, 1899. [Dec 2018 (4 Marks)]

Answer:

Lease [Section 2(16)]: Lease means a lease of immovable property and also includes:

(a) a Patta;

(b) a Kabuliyat or other undertaking in writing, not being a counterpart of a lease to cultivate, occupy or pay or deliver rent for, immovable property;

(c) any instrument by which tolls of any description are let;

(d) any writing on an application for a lease intended to signify that the application is granted.

A Patta is an instrument given by the Collector of District or any other receiver of the revenue, to the cultivator, specifying the Condition or conditions upon which the lands are to be held and the value or proportion of the products to be paid, therefore.

A Kabuliyat is executed by the lessee, accepting the terms of the lease and undertaking to abide by them. Although it is not a lease u/s 105 of the Transfer of Property Act, it is expressly included in the definition for the purposes of the Stamp Act.

The toll is a tax paid for some liberty or privilege, such as for passage over a bridge, ferry, along a highway or for the sale of articles in a market or fair or the like. It does not include octroi or Chungi

Question 6.

Distinguish between executed and execution under the Indian Stamp Act, 1S99. [June 2019 (4 Marks)]

Answer:

Executed/Execution [Section 2(12)]: The words ‘executed’ and ‘execution, I used with reference to instruments mean ‘signed’ and ‘signature’ and includes | attribution of electronic record within the meaning of Section 11 of the j Information Technology Act, 2000.

Signature includes a mark by an illiterate person. [Section 3(52), General Clauses Act, 1897]

An instrument that is chargeable with stamp duty only on being “executed” is not liable to stamp duty until it is signed.

Question 7.

List any ten instruments which are chargeable with duty under the Indian Stamp Act, 1899. [Dec 2010 (5 Marks)]

Answer:

Ten instruments that are chargeable with duty under the Indian Stamp Act, 1899 are as follows:

- Administration Bond

- Agreement relating to Deposit of Title-deeds, Pawn or Pledge

- Bill of Exchange

- Bond

- Debenture

- Indemnity-bond

- Mortgage-deed

- Promissory-note

- Release

- Security Bond or Mortgage-deed

- Settlement.

Question 8.

State the instruments which are chargeable with duty under the Indian Stamp Act, 1899. [Dec 2011 (4 Marks)]

Answer:

Instruments chargeable with duty [Section 3]: Subject to the provisions of the Act and the exceptions contained in Schedule I, the following instruments shall be chargeable with a duty of the amount indicated in that schedule as the proper duty, namely:

- Instrument mentioned in 1st Schedule executed in India

- Bill of exchange except payable on demand and promissory note

- Every instrument executed out of India but related to property in India. However, no duty shall be chargeable in respect of:

- An instrument executed by and in favour of the Government.

- Instrument related to sale or deposition of ship or vessels registered under Merchant Shipping Act, 1894 or the Indian Registration of Ships Act, 1841

- Any instrument executed by, or, on behalf of, or in favour of, the Developer or Unit or in connection with the carrying out of purposes of the Special Economic Zone.

Question 9.

Abhay’s agricultural land was purchased by the government for the purpose of construction of a factory but no duty was paid for this transfer by the government. Abhay wanted to take back his land on the ground that the government has not paid the duty and, therefore, no sale deed was executed. Will Abhay succeed? Give reasons. [Dec 2010 (4 Marks)]

Answer:

As per Section 3 of the Indian Stamp Act, 1899, no duty shall be chargeable | in respect of instrument executed by and in favour of Government. Since) Abhay’s agricultural land was purchased by the government no stamp duty is required to pay on it and the instrument of transfer is valid. Thus, Abhay cannot take back his land on the ground that the government has not paid the duty.

Question 10.

What is the extent of liability of instruments to stamp duty where several instruments are executed in a single transaction? Explain with anyone illustration. [Dec 2019 (4 Marks)]

Answer:

Several instruments used in a single transaction of sale, mortgage or settlement [Section 4]: In case of a sale, mortgage or settlement, if there are s several instruments for one transaction, stamp duty is payable only on one g instrument and on other instrument nominal stamp duty of ₹ 1 is payable.

Example: Pexecuted a conveyance of immovable property. On the same deed, his nephew (undivided in status) endorsed his consent to the sale, as such ®f consent was considered to be necessary. It was held that the conveyance was the principal instrument. The consent was chargeable with only ₹ 1

Question 11.

Ram executed a gift deed of certain immovable properties in favour of his brother Shyam. By another deed, Shyam made provision for the living expenses of Ram and created a charge in his favour on some properties included in the above-mentioned gift deed in order to secure the payment of these living expenses. The government authority insists that the deed executed by Shyam is liable to full duty. Decide with reasons. [Dec 2003 (5 Marks)]

Answer:

According to Section 4 of the Indian Stamp Act, 1899, if there are several instruments for one transaction, stamp duty is payable only on one instrument and on other instrument nominal stamp duty of Re. 1 is payable.

Facts of the case are similar to Maharaj Someshar Dutt, wherein it was held that, when two deeds (documents) are executed by 2 brothers, one document transferred all the property by way of gift and was stamped to it is full value, the second document provided expenses during the lifetime of the transferor, the two documents were part of the same transaction. They amounted to a settlement and Section 4 applied and hence on the second document nominal stamp duty of ₹ 1 is payable.

Question 12.

Arjun executed a power of attorney both in his personal capacity and in his capacity as an executor, trustee, manager and liquidator in favour of Bheem. Decide the liability of duty payable on the instrument. [Dec 2005 (5 Marks)]

Answer:

According to Section 5 of the Indian Stamp Act, 1899, if one instrument relates to several distinct matters, stamp duty payable is the aggregate amount of stamp duty payable on a separate instrument.

Where a person possessing a ‘representative capacity such as trustee and a personal capacity and if he delegates his powers under both the categories then Section 5 is attracted and stamp duty payable is the aggregate amount of stamp duty payable on a separate instrument.

Question 13.

Are securities dealt in depository liable to stamp duty under the provisions of Indian Stamp Act, 1899? [June 2017 (5 Marks)]

Answer:

Securities dealt in depository not liable to stamp duty [Section 8A]: The Finance Act, 2019 substituted Section 8A which reads as follows:

Notwithstanding anything contained in the Act or any other law for the time being in force:

- An issuer, by the issue of securities to one or more depositories, shall, in respect of such issue, be chargeable with duty on the total amount of securities issued by it and such securities need not be stamped.

- The transfer of registered ownership of securities from a person to a depository or from a depository to a beneficial owner shall not be liable to duty.

Question 14.

What are the provisions of reduction, remission & compounding of duties by the Government under the Indian Stamps Act, 1899?

Answer:

Power to reduce, remit or compound duties [Section 9]: This Section empowers the government to reduce or remit whole or part of duties payable. Such reduction or remission can be in respect of whole or part of territories and also can be for a particular class of persons. Government can also compound or consolidate duties in case of the issue of shares or debenture by companies.

‘Government’ means Central Government in respect of stamp duties on bills of exchange, cheque, receipts etc. and ‘State Government’ in case of stamp duties on other documents.

Question 15.

Four adhesive stamps were used on an instrument. The first adhesive stamp had a single line drawn across the face of the stamp. On the second stamp, there were two parallel lines. The third stamp had three parallel lines, and the fourth stamp had two lines crossing each other. What are the provisions for cancellation of adhesive stamps and which adhesive stamps referred to above will be considered to have been properly cancelled? [Dec 2009 (6 Marks)]

Answer:

As per Section 12(3) of the Indian Stamp Act. 1899, cancellation of an adhesive stamp may be done by the person by writing:

- His name or initial or

- Name or initials of his firm or

- Any other effectual manner.

Stamps may be effetely cancelled by drawing a line across it. [Mahadeo v. Sheroji Ram Teli]

Drawing a diagonal line across the stamp is effectual cancellation. [Melaram v. Brijlal]

Where one of the four stamps used on an instrument had a single line drawn across the face of the stamp, the second had two parallel lines, the third three parallel lines and the fourth two lines crossing each other, it was held that the stamps must be regarded as having been cancelled in a manner so that they could not be used again. [In re. Tata Iron Steel Company, AIR 1928 Bom. 80]

Thus keeping in view above, all four stamps are effectively cancelled.

Question 16.

When the instruments may be stamped with adhesive stamps, under the Indian Stamps Act, 1899? When and by whom such adhesive stamps may be cancelled? [Dec 2018 (5 Marks)]

Answer:

1. Section 11 of the Indian Stamp Act, 1899 provides that the following instruments may be stamped with adhesive stamps, namely:

(a) instruments chargeable with a duty not exceeding 10 maybe paise except parts of bills of exchange payable otherwise than on demand and drawn insets;

(b) bills oF exchange and promissory notes drawn or made out of India;

(c) entry as an advocate, vakil or attorney on the role of a High Court;

(d) notarial acts; and

(e) transfers b endorsement of shares in an incorporated company or other body corporate.

2. Section l2(l)(a) of the Indian Stamp Act, 1899, provides that any the person affixing any adhesive stamp to any instrument chargeable with the duty which has been executed by another person shall when affixing such stamp cancel the same so that it cannot be used again.

3. Under Section l2(1)(b, an obligation has been imposed on the person executing any instrument on any paper bearing an adhesive stamp, to cancel the stamp, if such cancellation has not been done, at the time of such execution.

4. Under Section 12(2) of the Indian Stamp Act, 1899, any instrument bear¬ing an adhesive stamp that has not been cancelled, so that it cannot be used again is deemed to be unstamped.

Question 17.

What are the modes of cancellation of adhesive stamps? [June 2012 (5 Marks), Dec. 2014 (4 Marks)]

Answer:

Section 12 of the Indian Stamp Act, 1899 makes the following provisions for the cancellation of stamps.

Cancellation of adhesive stamps: Any person affixing an adhesive stamp has to cancel it. If it is not cancelled as above then it should be cancelled by the person executing it. A stamp has to be cancelled in such a manner that it cannot be used again.

Effect of not cancelling the stamps: If stamps are not cancelled then the instrument is treated as deemed to be unstamped.

Mode of cancellation of an adhesive stamp: Cancellation of an adhesive stamp may be done by the person by writing.

- His name or initial or

- Name or initials of his firm or

- Any other effectual manner.

Question 18.

Write a short note on the Mode of cancellation of adhesive stamps under the Indian Stamps Act, 1899. [June 2015 (5 Marks)]

Answer:

Section 12 of the Indian Stamp Act, 1899 makes the following provisions for the cancellation of stamps.

Cancellation of adhesive stamps: Any person affixing an adhesive stamp has to cancel it. If it is not cancelled as above then it should be cancelled by the person executing it. A stamp has to be cancelled in such a manner that it cannot be used again.

Effect of not cancelling the stamps: If stamps are not cancelled then the instrument is treated as deemed to be unstamped.

Mode of cancellation of an adhesive stamp: Cancellation of an adhesive stamp may be done by the person by writing.

- His name or initial or

- Name or initials of his firm or

- Any other effectual manner.

Question 19.

What is ‘e-stamping? Also, discuss its benefits. [Dec 2016 (3 Marks)]

Answer:

E-Stamping is a computer-based application and a secured way of paying Non-Judicial stamp duty to the Government. The prevailing system of physical stamp paper/franking is being replaced by an E-stamping system. Stock Holding Corporation of India Ltd. (SHCIL) has been promoted by All India Public

Financial Institutions and Insurance Majors.

- SHCIL is known for its security, integrity, wide network and focuses on technology.

- SHCIL is the only Central Record Keeping Agency (CRA) appointed by the Government of India. The CRA is responsible for User Registration, Imprest Balance Administration and overall E-Stamping application operations and maintenance.

Benefits of E-Stamping:

- E-Stamp Certificate can be generated within minutes.

- E-Stamp Certificate generated is tamper-proof.

- The authenticity of the e-St amp certificate call is checked through the inquiry module.

- E-Stamp Certificate generated has a Unique Identification Number.

- The specific denomination is not required.

- An E-stamp certificate can be checked by any person through the recommended site.

Question 20.

Write a short note on Denoting Duty [June 2008 (4 Marks)]

Answer:

Denoting Duty [Section 16]: Where the stamp duty to be paid on a particular instrument or exemption of such instrument from duty depends upon another instrument, then if both are produced before Collector of Stamps he can denote & certify on the first instrument that proper stamp duty is paid or no duty is required to be paid.

Question 21.

In respect of foreign instruments, other than bills and notes received in India, what is the time limit prescribed for stamping those instruments? [Dec 2006 (4 Marks)]

Answer:

As per Section 18, the instrument executed out of India may be stamped within 3 months after it is 1 st received in India.

Question 22.

A promissory note is executed by Suresh and Udit and the stamp is afterwards affixed and cancelled by Suresh by again signing it. Explain whether the provisions of section 17 relating to the time of stamping instruments have been complied with? [June 2019 (4 Marks)]

Answer:

Instruments executed in India [Section 17]: Instruments chargeable with duty and executed by any person in India shall be stamped before or at the time of execution.

Where a promissory note is executed by ‘A’ and ‘B’ and a stamp is afterwards affixed and cancelled by ‘A’ by again signing it, the stamping has taken place subsequent to the execution and hence, the provisions of Section 17 are not complied with. [Rohini v. Fernandes]

Question 23.

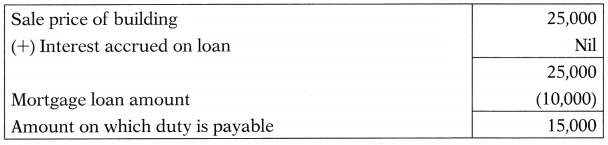

Unfit mortgages a house of the value of 25,000 to Bimal for 10,000. Bimal afterwards buys the house from Amit. Whether the stamp duty already paid is deductible from the stamp duty payable on 25,000? [June 2012 (4 Marks)]

Answer:

According to Section 24, if the property is transferred in satisfaction of a debt due, then it will be considered for valuation purpose. However, as the Explanation to Section 24, where the property is subject to a mortgage is transferred to the mortgagee, he shall be entitled to deduct from the duty payable on the transfer, the amount of any duty already paid in respect of the mortgage.

Considering the above provision duty payable will be calculated as follows:

Question 24.

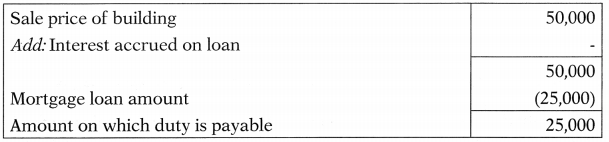

Atul mortgages his house of the value of 50,000 to Vijay. After some time Vijay buys the house from Atul for 25,000. Decide the amount on which Vijay has to pay the stamp duty under Indian Stamp Act, 1899. [Dec 2018 (4 Marks)]

Answer:

According to Section 24 of the Indian Stamp Act, 1899, if the property is transferred in satisfaction of a debt due, then it will be considered for valuation purpose. However, as the Explanation to Section 24, where the property is subject to a mortgage is transferred to the mortgagee, he shall be entitled to deduct from the duty payable on the transfer, the amount of any duty already paid in respect of the mortgage.

Considering the above provision duty payable will be calculated as follows:

Question 25.

Who are the persons liable to pay the stamp duty under the Indian Stamp Act, 1899 in the following cases?

(i) Mortgage deed

(ii) Policy of insurance other Ilian fire Insurance

(iii) Sale of security through stock exchange [June 2003 (5 Marks)]

Answer:

Duties by whom payable [Section 29]:

| Instrument/deed/ document | Person liable to pay stamp duty |

| Mortgage-deed | A person drawing, making/executing such instrument |

| The policy of insurance other than fire Insurance | The person taking the policy |

| Sale of security through stock exchange | Buyer of such security |

Question 26.

You are Company Secretary of Dowell Industries (India) Ltd. You are about to execute an agreement with a third party on behalf of the company. However, you are not sure as to correct stamp duty payable. State how will you go about determining as to correct stamp duty with which the agreement is chargeable. [June 2000 (8 Marks)]

Answer:

Adjudication as to proper stamp [Section 31]: 11 any person is not sure about the duty payable on any instrument, then he can apply to the Collector of stamps for his opinion regarding duty payable.

Fee: Such an application has to be made with a fee of ₹ 5.

Documents to be attached: While making an application to the collector following documents should be attached:

- Abstract of the instrument

- Affidavit

- Other evidence as may be required by Collector

- Fee.

Question 27.

Explain the consequences of the instruments which are not duly stamped under the Indian Stamp Act, 1899. [June 2010 (4 Marks)]

Or

Explain the consequences that follow where the instruments are not duly stamped under the Indian Stamp Act, 1899. [Dec 2014 (4 Marks)]

Answer:

Following are the consequences of the instruments not duly stamped:

1. Impounding of the instrument not duly stamped [Section 33]: If any instru¬ment is not duly stamped then it can be impounded under this section by:

- Arbitrator

- Court

- Public officer (Police officer is excluded i.e. to say he cannot impound the instrument)

2. Impounding of unstamped receipt [Section 34]: Unstamped receipts can be impounded by a public accountant or he may require the receipt to be stamped.

3. Instruments not duly stamped inadmissible in evidence [Section 35]:

Shortcomings of the instrument not duly stamped are as follows:

- Such instrument cannot be accepted as evidence by Civil Court or Arbitrators.

- No one can act upon it.

- It cannot be registered.

- Such an instrument cannot be authenticated by a public officer or public authorities.

However, if proper stamp duty & penalty is paid then above mentioned shortcomings go and it becomes valid.

4. Admission of the instrument – where not be questioned [Section 36]: Once a document is admitted in evidence (whether rightly or wrongly) is not permissible to the Court whether it is Court of appeal, revision or of the first instance to go behind that order.

Question 28.

Discuss the evidentiary value of an instrument not duly stamped under the Indian Stamp Act, 1899. [June 2013 (4 Marks)]

Answer:

Following are the consequences of the instruments not duly stamped:

1. Impounding of the instrument not duly stamped [Section 33]: If any instru¬ment is not duly stamped then it can be impounded under this section by:

- Arbitrator

- Court

- Public officer (Police officer is excluded i.e. to say he cannot impound the instrument)

2. Impounding of unstamped receipt [Section 34]: Unstamped receipts can be impounded by a public accountant or he may require the receipt to be stamped.

3. Instruments not duly stamped inadmissible in evidence [Section 35]:

Shortcomings of the instrument not duly stamped are as follows:

- Such instrument cannot be accepted as evidence by Civil Court or Arbitrators.

- No one can act upon it.

- It cannot be registered.

- Such an instrument cannot be authenticated by a public officer or public authorities.

However, if proper stamp duty & penalty is paid then above mentioned shortcomings go and it becomes valid.

4. Admission of the instrument – where not be questioned [Section 36]: Once a document is admitted in evidence (whether rightly or wrongly) is not permissible to the Court whether it is Court of appeal, revision or of the first instance to go behind that order.

Question 29.

An instrument bears a stamp of sufficient amount, but of improper description. Can be certified as duly stamped? How the instrument can be rectified and what would be the date of execution? [June 2013 (6 Marks)]

Answer:

Admission of the improperly stamped instrument [Section 37]: Opportunity is given under this section to a party for getting a mistake rectified when a stamp of proper amount, but of improper description has been used.

The State Government may make rules for an instrument that bears a stamp of sufficient amount but of improper description. On payment of stamp duty of proper description, any instrument so certified shall be deemed to have been duly stamped as from the date of its execution.

Question 30.

Achal gives an instrument to Basu which is unstamped. This instrument is also not registered

(i) Will the instrument be admitted in evidence?

(ii) Will the situation change if the instrument is stamped but not registered before passing to Basu and Basu get it registered subsequently? [June 2013 (5 Marks)]

Answer:

Instruments not duly stamped inadmissible in evidence [Section 35]:

Shortcomings of the instrument not duly stamped are as follows:

- Such instrument cannot be accepted as evidence by Civil Court or Arbi¬trators.

- No one can act upon it.

- It cannot be registered.

- Such an instrument cannot be authenticated by a public officer or public authorities.

However, if proper stamp duty & penalty is paid then above mentioned shortcomings go and it becomes valid.

Keeping in view the above provisions answer to the given case is as follows:

- The instrument cannot be admitted in evidence since it is not stamped.

- If the instrument is stamped before registration then it can be registered subsequently.

Question 31.

State the law of inadmissibility in evidence of an instrument not duly stamped. [Dec 2013 (3 Marks)]

Answer:

Instruments not duly stamped inadmissible in evidence [Section 35]:

Shortcomings of the instrument not duly stamped are as follows:

- Such instrument cannot be accepted as evidence by Civil Court or Arbi¬trators.

- No one can act upon it.

- It cannot be registered.

- Such an instrument cannot be authenticated by a public officer or public authorities.

However, if proper stamp duty & penalty is paid then above mentioned shortcomings go and it becomes valid.

Keeping in view the above provisions answer to the given case is as follows:

- The instrument cannot be admitted in evidence since it is not stamped.

- If the instrument is stamped before registration then it can be registered subsequently.

Question 32.

“If once the ‘instrument’ has been admitted in evidence, it shall not be questioned later on in the same suit on the ground that it does not bear the adequate stamp duty or no stamp.” Discuss briefly with reference to case law. [June 2016 (5 Marks)]

Answer:

Instruments not duly stamped inadmissible in evidence [Section 35]:

Shortcomings of the instrument not duly stamped are as follows:

- Such instrument cannot be accepted as evidence by Civil Court or Arbi- tractors.

- No one can act upon it.

- It cannot be registered.

- Such an instrument cannot be authenticated by a public officer or public authorities.

However, if proper stamp duty & penalty is paid then above mentioned shortcomings go and it becomes valid.

An insufficiently stamped instrument is not invalid and it can be admitted in evidence on payment of penalty.

Instrument not duly stamped can be accepted as evidence in Criminal Court. Instrument not duly stamped is also admissible if it is executed by the government.

Question 33.

Mention the circumstances under which refund of stamp duty or penalty may be made by the revenue authorities. [June 2011 (4 Marks)]

Answer:

Sections 49 to 54 deals with the provisions relating to refund of stamp duty.

Allowance for spoiled stamps before the document is executed [Section 49(a) to (c)]: If after purchasing of stamp paper it becomes unfit because it is spoiled, obliterated or there is an error while writing on it, then the application can be made | for refund. However, such stamp paper should not be executed (i.e. signed).

Allowance for spoiled stamps after the document is executed [Section 49(d)]: If the bill of exchange (not payable on demand) or promissory note is signed but has not been accepted or made use of in any manner and have not been delivered to any person, allowances for impressed stamp can be claimed.

If stamp paper is purchased and executed (i.e. signed) after writing, a refund can be claimed in the following circumstance.

- The document was found void under any law.

- Document found unfit for the purpose for which it is purchased.

- One of the parties refuses to sign.

- Purpose fails as one of the party refuses to act on the same.

- If it is deficient in value.

- If it is inadvertently spoiled.

Allowance in case of printed forms no longer required by corporations [Section 51]: If some companies, banks or incorporated bodies purchase stamp papers and print their forms on such paper and if there are unable to use the same for any reason, they can claim a refund.

Time limit: Ho time limit has been prescribed.

Who can allow such a refund?

- Chief Controlling Revenue Authority.

- Collector, if authorized by Chief Controlling Revenue Authority.

Allowance for misused stamps [Section 52]: If wrong types of stamps are inadvertently used or inadvertently higher duty stamps are used, then refund / f allowance can be claimed.

Procedure: Application has to be made to Collector within 6 months from the date of purchase.

Allowance for spoiled or misused stamps how to be made [Section 53]: In any case in which allowance is made for spoiled or misused stamps, any one of the following course may be adopted by the Collector.

- A collector may give other stamps of the same description and value.

- A collector may give stamps of any other description to the same amount in value.

- A collector may give the same value in money, deducting ten Naya paisa for each rupee or fraction of a rupee. (Money will be given after deducting 1096 of the value of stamps)

Allowance for stamps not required for use [Section 54]: If a person does not need stamps brought by him for immediate use, he can claim allowance/refund.

- Conditions: Stamps should not be spoiled or rendered unfit.

- Procedure: Application has to be made to Collector within 6 months from the date of purchase.

How much amount is refunded: Collector can repay the person applied the value of such stamp deducting ten Naya paisa for each rupee or portion of the rupee. (Thus, effectively 9096 amount can be refunded).

Where the person is a licensed vendor of stamps, the Collector may refund the whole amount.

Question 34.

Explain the Collector’s power to stamp an instrument that is impounded. [June 2014 (4 Marks)]

Answer:

Section 40 deals with Collector’s powers to stamp an instrument that is impounded. Under Section 40(1), the Collector when impounding any instrument under Section 33, or receiving any instrument under Section 38(2) shall adopt the following procedure:

- if he is of the opinion that instrument is duly stamped or is not chargeable with duty, he shall certify by endorsement thereon that it is duly stamped, or that it is not so changeable as the case may be;

- if he is of the opinion that such instrument, is chargeable with duty and is not duly stamped, he shall require the payment of the proper duty or the amount required to make up the same, together with a penalty of Rs. 5/-, if he thinks fit and amount not exceeding ten times the amount of the proper duty or of the deficient portion thereof, whether such amount exceeds or falls short of Rs. 5/-.

The Collector, however, has the discretion to remit the whole penalty leviable under this Section in a case where the instrument has been impounded only because it has been written in contravention of Section 13 or Section 14.

Question 35.

State the provisions of the Indian Stamp Act, 1899 regarding the payment of stamp duty for renewing debentures. [Dec 2017 (5 Marks)]

Answer:

Allowance on renewal of certain debentures [Section 5 5]: If old debenture is renewed and on both stamp duty is paid then stamp duty on old debenture is refundable.

Condition: Old debenture should be produced before cancellation to Collector.

Explanation to Section 55 says that provisions are also applicable in the following cases:

- Issue of 2 or more debenture in place 1 old debenture. (Sub-division)

- Issue of 1 new debenture in place 2 or more old debentures. (Consolidation)

- Substitution of the name of the holder at the time of renewal for the name of the original holder.

- Alteration of the rate of interest or the dates of payment.

Question 36.

Write a short note on Reference and Revision under the Indian Stamp ACC 1899.

Answer:

Reference by Collector to CCRA [Section 56]: Collector of stamps is a main authority under the Act. His powers are subject to the control of the Chief Controlling Revenue Authority (CCRA). If Collector feels doubt as to the amount of duty with which any instrument is chargeable, he may refer it for the decision of CCRA. The CCRA shall consider the case and send a copy of its decision to \ the Collector who shall proceed to assess and charge the duty in conformity with such decision.

Reference by CCRA to High Court [Section 57]: If CCRA cannot decide a case then it may refer such case to High Court. Similarly, if any other Court feels doubt about the amount of duty payable, can make a reference to High Court.

Question 37.

Name of the officers of the Company who can be held liable in case the Company has issued share warrant without proper stamp duty. What shall be the penalty as prescribed under Sec. 62(2) of the Stamp Act. [Dec 2019 (4 Marks)]

Answer:

Section 62 of the Indian Stamp Act, 1899 provides that if a share-warrant is issued without being duly stamped, the company issuing the same, and also every person who, at the time when it is issued, its managing director or secretary or other principal officers of the company, shall be punishable with fine which may extend to ₹ 500.