Question 1.

The power to invest funds of the company is the prerogative of the board of directors under section 179. Discuss the limitations on such powers of the board, if any, relating to inter-corporate loans and investments under section 186. (December 2019) (6 marks)

Or

Your company, which is a public limited company wishes to make investments in shares of a company. The total investment exceeds the statutory limit stipulated by the Companies Act, 2013. What are the formalities to be com¬plied within this regard? (June 2013) (4 marks)

Answer:

1. Under Section 179, the power to invest funds of the company is the prerogative of the board of directors but subject to limitation under Section 186(2) of the Companies Act, 2013.

No Company shall, directly or indirectly:

- give any loan to any person or other body corporate;

- give any guarantee, or provide security, in connection with a loan to any other body corporate or person; and

- acquire, by way of subscription, purchase or otherwise the securities of any other body corporate;

exceeding 60% of its paid-up share capital, free reserves, and securities premium account or 100% of its free reserves and securities premium account, whichever is more unless the same is previously authorized by a special resolution passed in a general meeting.

Explanation: For the purposes of this subsection, the word “person” does not include any individual who is in the employment of the company.

2. Prior approval by Special Resolution [Section 186 (3)]

Where the aggregate of the loans and investment so far made, the amount for which guarantee or security so far provided to or in all other bodies corporate along with the investment, loan, guarantee or security proposed to be made or given by the Board, exceed the limits specified under sub-section (2) (above mentioned), no investment or loan shall be made or guarantee shall be given or security shall be provided unless previously authorized by a special resolution passed in a general meeting.

Question 2.

As of 31st March 2015, the balance sheet of ABC Limited shows the following:

| INR in Crores | |

| Paid-up share capital | 30 |

| Reserves and surplus | 40 |

| Reserve for the redemption of debentures | 20 |

| Capital Reserve | 10 |

The company made loan/stood guarantee for loans to other companies as below:

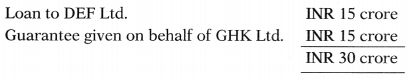

| Loan to DEF Limited | INR 15 crores |

| Guarantee is given on behalf of GHK Limited | INR 15 crores |

LKP Limited approached ABC Limited for a loan of an amount of INR 20 crore. Advice the management of ABC Limited as to whether the company can give a loan of INR 20 Crore to LKP Limited. (June 2011) (4 marks)

Answer:

Paid-up share capital: INR 30 crores

Free Reserves: INR 5 crores

Securities Premium: NIL

Calculation of Overall Limit

Higher of the following two:

- [30+40] × 60% = INR 42 crores

- 40 × 100% = INR 40 crores

Loan and Investment already made:

Proposed Loan to LKP Ltd:

Since investment/loan/guarantee already made or given (INR 30 crore) along with the proposed loan (INR 20 Crore) exceeds the prescribed limit, the proposed loan can be given by taking prior approval by means of a special resolution passed at a general meeting under Section 186(3) of the Companies Act, 2013.

Question 3.

The Board of directors of Joy Limited, by a resolution, passed at its meeting, decide to provide a loan of INR 50 Crores to Happy Limited. The paid-up share capital of Joy Limited on the date of the resolution was INR 100 crores and the aggregate balance in the Free Reserves and Securities Premium Account stood at INR 40 crores. Examining the provisions of the Companies Act, 2013 decide whether the board’s resolution to provide a loan of INR 50 crore to Happy Limited is valid? (June 2015) (4 marks)

Answer:

Paid-up share capital:

Free Reserves & Securities Premium

Calculation of Overall Limit

Higher of the following two:

- [100+40] × 60% = INR 84 crores

- 40 × 100% = INR 40 crores

Proposed Loan to Happy Ltd.

Since the proposed loan does not exceed the prescribed limit, the proposed loan can be given by passing a unanimous resolution in a Board Meeting and prior approval by means of a special resolution passed at a general meeting under Section 186(3) of the Companies Act, 2013 shall not be necessary.

Question 4.

RR limited has decided to make investments in other companies for INR 50 lakhs, which is in excess of 60% of the company’s paid-up share capital, free reserves, and securities premium account. The company has 5 directors. Four directors were present in the Board meeting, three directors have given their consent but one director abstained from voting. The decision of the Board was noted in the minutes of the Board meeting and decided to make such investment bypassing of Board Resolution with the majority. Referring to the provisions of the Companies Act, 2013, examine the validity of the Board’s decision. (June 2017) (4 marks)

Answer:

1. As per Section 186(2) of the Companies Act, 2013:

No Company shall, directly or indirectly:

- give any loan to any person or other body corporate;

- give any guarantee, or provide security, in connection with a loan to any other body corporate or person; and

- acquire, by way of subscription, purchase or otherwise the securities of any other body corporate;

exceeding 6096 of its paid-up share capital, free reserves, and securities premium account or 10096 of its free reserves and securities premium account, whichever is more unless the same is previously authorized by a special resolution passed in a general meeting.

2. As per Section 186(3) of the Companies Act, 2013, Where the aggregate of the loans and investment so far made, the amount for which guaran¬tee or security so far provided to or in all other bodies corporate along with the investment, loan, guarantee or security proposed to be made or given by the Board, exceed the limits specified under sub-section (2) (above mentioned), no investment or loan shall be made or guarantee shall be given or security shall be provided unless previously authorized by a special resolution passed in a general meeting.

3. As per Section 186(5) of the Companies Act, 2013, provides that no investment shall be made or loan or guarantee or security given by the company unless the resolution sanctioning it is passed at a meeting of the Board with the consent of all the directors present at the meeting and the prior approval of the public financial institution concerned where any term loan is subsisting is obtained.

4. In the given case, RR limited has decided to make investments in other companies for INR 50 lakhs, which is in excess of 60% of the company’s paid-up share capital, free reserves, and securities premium account. The company has 5 directors. Four directors were present in the Board meeting, three directors have given their consent but one director abstained from voting.

Question 5.

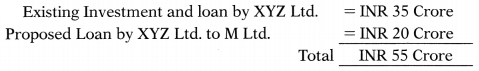

XYZ Limited, a company, has a paid-up share capital of INR 60 crores and a free reserve of INR 25 crores. It desires to make a loan of INR 20 crore to M Limited. The company XYZ Limited has already made investments in many other companies including loans to the extent of INR 35 Crores. Can the company go ahead with a loan to M Limited? Please advise the company about the procedures to be followed by it. (December 2017) (4 marks)

Answer:

1. As per Section 186(2) of the Companies Act, 2013:

No Company shall, directly or indirectly:

- give any loan to any person or other body corporate;

- give any guarantee, or provide security, in connection with a loan to any other body corporate or person; and

- acquire, by way of subscription, purchase or otherwise the securities of any other body corporate; exceeding 60% of its paid-up share capital, free reserves, and securities premium account or 100% of its free reserves and securities premium account, whichever is more unless the same is previously authorized by a special resolution passed in a general meeting.

2. As per Section 186(3) of the Companies Act, 2013, Where the aggregate of the loans and investment so far made, the amount for which guaran-tee or security so far provided to or in all other bodies corporate along with the investment, loan, guarantee or security proposed to be made or given by the Board, exceed the limits specified under sub-section (2) (above mentioned), no investment or loan shall be made or guarantee shall be given or security shall be provided unless previously authorized by a special resolution passed in a general meeting.

Paid-up share capital: INR 60 crore

Free Reserves & Securities Premium: INR 25 crore

Calculation of Overall Limit: Higher of the following two:

[60+25] × 60% = INR 51 crore

25 × 100% = INR 25 crore

Since proposed investment exceeds the prescribed limit, proposed investment can be made by taking prior approval by means of a special resolution passed at a general meeting under Section 186(3) of the Companies Act, 2013.

Question 6.

State the procedure for granting a loan by one company to another company. (June 2011) (6 marks)

Answer:

1. Convene the Board Meeting as per the provisions of the Companies Act, 2013 to consider the proposal to give loan, guarantee or provide security or make investment other body corporate or person.

(a) If the aggregate amount of proposed loan/guarantee/security/ investment is within the limits then pass the resolution with all the directors present at the meeting consenting to specify the limit for such loan/guarantee/security/investment.

(b) If the aggregate amount of proposed loan/guarantee/security/ investment is exceeding the specified limits then fix time, date, and venue for holding a general meeting to pass the special resolution.

2. Draft notice of the special resolution which must contain the prescribed details.

3. Issue notice in writing 21 clear days before the date of the general meeting.

4. In case of Listed companies, send 3 copies of the notice to Stock Ex-change^) where securities are listed.

5. Hold the General meeting and pass the special resolution.

If a company having more than 200 members, the special resolution is required to be passed by Postal Ballot.

6. File e-From MGT-14 with Registrar of companies within 30 days of passing the special resolution.

7. Enter the prescribed particulars in the register of inter-corporate loans & investments within 7 days.

Question 7.

What transactions are considered as ‘related party transactions under the provisions of the Companies Act, 2013? Explain. (June 2015) (4 marks)

Answer:

Related Party Transactions [Section 188(1)] of the Companies Act, 2013, provides that except with the consent of the Board of Directors given by a resolution at a meeting of the Board and subject to such conditions as prescribed under Rule 15 of the Companies (Meetings of Board and its Powers) Rules, 2014,

No company shall enter into any contract or arrangement with a related party with respect to:

- sale, purchase, or supply of any goods or materials;

- selling or otherwise disposing of, or buying, property of any kind;

- leasing of property of any kind;

- availing or rendering of any services;

- appointment of any agent for purchase or sale of goods, materials, services, or property;

- such related party’s appointment to any office or place of profit in the company, its subsidiary company or associate company; and

- underwriting the subscription of any securities or derivatives thereof of the company:

Provided that no contract or arrangement, in the case of a company having a paid-up share capital of not less than such amount, or transactions not exceeding such sums, as may be prescribed in Rule 15 of Companies (Meetings of Board and its Powers) Rules, 2014 shall be entered into except with the prior approval of the company by a resolution:

Provided further that no member of the company shall vote on such resolution, to approve any contract or arrangement which may be entered into by the company, if such member is a related party.

Note: Amended As per MCA Notification dated 02nd March 2020, Both First and second proviso to sub-section

1. of Section 188 shall not apply to :

(a) a Government company in respect of contracts or arrangements entered into by it with any other Government company, or with Central Government or any State Government or any combination thereof;

(b) a Government company, other than a listed company, in respect of contracts or arrangements other than those referred to in clause (a), in case such company obtains approval of the Ministry or Department of the Central Government which is administratively in charge of the company, or, as the case may be, the State Government before entering into such contract or arrangement.

However, nothing contained in the second proviso shall apply to a company in which ninety percent or more members, in number, are relatives of promoters or are related parties.

Further nothing in this sub-section shall apply to any transactions entered into by the company in its ordinary course of business other than transactions that are not on an arm’s length basis.

Furthermore, the requirement of passing the resolution under the first proviso shall not be applicable for transactions entered into between a holding company and its wholly-owned subsidiary whose accounts are consolidated with such holding company and placed before the shareholders at the general meeting for approval.

Question 8.

Distinguish between ‘Related Party’ and ‘Relative’ as defined and applied under the Companies Act, 2013. (December 2017) (4 marks)

Answer:

1. Relative [Section 2(77) of the Companies Act, 2013]:

Relative means anyone who is related to another if-

- they are members of the Hindu Undivided Family;

- they are husband and wife; or

- one person is related to another in accordance with Rule 4 of Companies (Specifications of Details) Rules, 2014.

A person shall be deemed to be the relative of another, if he or she is related to another in the following manner, namely:

- Father: Provided that the term “Father” includes step-father.

- Mother: Provided that the term “Mother” includes the stepmother.

- Son: Provided that the term “Son” includes the step-son.

- Son’s wife

- Daughter

- Daughter’s husband

- Brother: Provided that the term “Brother” includes the step-brother;

- Sister: Provided that the term “Sister” includes the step-sister.

2. Related Party [Section 2(76) of the Companies Act, 2013]

According to Section 2(76) of Companies Act, 2013, “related party”, with reference to a company, means—

- a director or his relative;

- key managerial personnel or his relative;

- a firm, in which a director, manager, or his relative is a partner;

- a private company in which a director or manager or his relative is a member or director

- a public company in which a director or manager is a director and holds along with his relatives, more than two percent (2%) of its paid-up share capital;

- anybody corporate whose Board of Directors, managing director or manager is accustomed to act in accordance with the advice, directions or instructions of a director or manager;

- any person on whose advice, directions, or instructions a director or manager is accustomed to act:

Provided that nothing in sub-clauses (6) and (7) shall apply to the advice, directions, or instructions given in a professional capacity; (8) anybody corporate which is:

- a holding, subsidiary, or an associate company of such company;

- a subsidiary of a holding company to which it is also a subsidiary;

- an investing company or the venturer of the company;

8. such other person as may be prescribed.

Question 9.

Who is a “related party” as defined in Section 2(76) of the Companies Act, 2013? (June 2019) (3 marks)

Answer:

Related Party [Section 2(76) of the Companies Act, 2013]

According to Section 2(76) of Companies Act, 2013, “related party”, with reference to a company, means—

1. a director or his relative;

2. key managerial personnel or his relative;

3. a firm, in which a director, manager, or his relative is a partner;

4. a private company in which a director or manager or his relative is a member or director;

5. a public company in which a director or manager is a director and holds along with his relatives, more than two percent (2%) of its paid-up share capital;

6. any body corporate whose Board of Directors, managing director, or manager is accustomed to act in accordance with the advice, directions, or instructions of a director or manager;

7. any person on whose advice, directions, or instructions a director or manager is accustomed to act:

However, nothing in sub-clauses (6) and (7) shall apply to the advice, directions, or instructions given in a professional capacity;

8. anybody corporate which is:

- a holding, subsidiary, or an associate company of such company;

- a subsidiary of a holding company to which it is also a subsidiary;

- an investing company or the venturer of the company.

9. such other person as may be prescribed:

Question 10.

The Board of directors of Wood Ltd. is authorized to borrow money up to INR 2 crore. The Board of directors got sanctioned a loan of Rs. 30 lakh from a bank for payment of debt liabilities of the company. But the Board of directors used this amount towards payment of their traveling & tour expenses. Will Wood Ltd. be held liable for repayment of the loan? Discuss. (December 2018) (3 marks)

Answer:

1. In decided case of V.K.R.S.T. Firm v. Oriental Insurance Trust Ltd. AIR 1994 Mad. 532 under the authority of the company, its Managing Director borrowed large sums of money and misappropriate it. The Company was held liable stating that where the borrowing is within the powers of the company. The lender will not be prejudiced simply because its officer has applied the loan to unauthorized activities provided the lender had no knowledge of the intended misuse.

2. In the given case, The Board of directors of Wood Ltd. is authorized to borrow money up to INR 2 crore. The Board of directors got sanctioned a loan of INR 30 lakh from a bank for payment of debt liabilities of the company. But the Board of directors used this amount towards payment of their traveling & tour expenses.

Thus, the lender would succeed in recovering the money from the company.

Question 11.

Draft an appropriate resolution to authorize the Board to borrow for the company’s business up to a limit beyond paid-up share capital and free reserves. Assume facts and figures. (December 2018)(5 marks)

Answer:

Under Section 180 of the Companies Act, 2013: Borrowing in excess of paid-up capital and free reserve:

Passing Authority –General Meeting

Nature of the Resolution –Special Resolution

“Resolved that the consent of the company be and is hereby accorded to the Board of Directors of the company under section 180(l)(e) and all applicable provisions if any, of the Companies Act, 2013, read with the article of association of the company, to borrow money for and on behalf of the company from time to time as deemed by it to be requisite and proper for the business of the company, but so that money to be borrowed together with the money already borrowed shall not exceed rupees 5,000 crore in excess of the aggregate of its paid-up share capital and free reserves of the company as per latest audited balance sheet, apart from temporary Loan obtained from the company’s banker in the ordinary course of business.”

“Resolved further that the consent of the company be and is hereby accorded to the Board of Directors of the company to create charge/provide security for .the sum borrowed on such terms and conditions as the Board of Directors think fit as may be acceptable to the lenders to secure borrowing of the company.”

“Resolved further that for the purpose of giving effect to this resolution, the Board of Directors be and is hereby authorized to do such acts, deeds, things, and matters as the Board of Directors may in its absolute discretion consider necessary or appropriate for such borrowing by the company.”

Explanatory Statement

[Explanatory statement to the resolution to be set out here.]

Question 12.

DEF Ltd. has made a profit for last 3 consecutive financial years as under:

| Year | ENR in crores |

| 2017-18 | 100 |

| 2016-17 | 150 |

| 2015-16 | 200 |

Considering the provisions of Companies Act 2013, state whether:

(i) DEF Ltd. can contribute Rs. 33.75 crore directly to a political party by a bearer cheque?

(ii) What is the limit on the maximum amount that can be contributed by a company to a political party?

(iii) Would your answer be different, if DEF Ltd. is a “Government Company” and donation is given by an “account payee cheque”? (June 2019) (1 + 2 + 2 = 5 marks)

Answer:

1. Prohibitions and Restrictions regarding Political Contributions:

Under Section 182 of the Companies Act, 2013, the following companies are prohibited from making a political contribution:

- Government Companies;

- Other companies have been in existence for less than three financial years.

2. The Aggregate of the political contributions in any financial year shall not exceed 7.596 of its average net profits during the three immediately preceding financial years.

3. The power to make a political contribution shall be exercised only by passing a resolution at the board meeting.

4. Calculation of average net profit of DEF Ltd:

Average net profit = 100+150+2003 = INR 150 crore.

Maximum political donation= INR 150 crore × 7.596 =INR 11.25 crore.

5. As DEF Ltd. is a Government Company, prohibited from making political contributions.

Note: As per Finance Act, 2017, w.e.f. 31.3.2017. The percentage of political contribution has been omitted.